Our portfolio

Explore the businesses decarbonizing the industrial economy.

Aloxe

Aloxe is a PET plastics recycling platform based in Europe. Aloxe intends to become a significant player in the recycled polyethylene terephthalate (rPET) market throughout Europe. The platform will address growing demand for rPET and the need for additional recycling capacity.

View website

Anesco

Anesco is a market leader in renewable energy, managing the development, design, construction, maintenance and market optimization of renewable energy and energy efficiency projects. The company has constructed more than 100 solar farms, while its O&M service is monitoring more than 24,000 sites.

View website

BioVeritas

BioVeritas, headquartered in Bryan, Texas, manufactures sustainable fuels and bio-chemicals for everyday life. BioVeritas’ proprietary mixed culture fermentation process produces low carbon, cost effective Sustainable Aviation Fuel from a wide variety of bio-based feedstocks.

View website

Blue Whale Materials

Blue Whale Materials recycles lithium-ion batteries to reclaim cobalt, nickel, lithium and manganese suitable for reuse in LIBs or other applications.

View website

Centric Infrastructure Group

Centric Infrastructure Group is an innovative local fiber and energy infrastructure company. It delivers energy and communications to residential and commercial customers in Texas.

View website

CFP Energy

CFP Energy is an award-winning risk management and solutions provider in the energy and environmental markets. Founded in 2006, the firm employs over 170 people in offices across Europe and the UK. Since inception, the Company has traded over 2.5 billion carbon credits in both the compliance and voluntary markets, provides risk management solutions in the power, gas and oil markets, and currently has a contract book of approximately 13 TWh of energy supply.

View website

Circulus

Circulus utilizes cutting-edge technologies to transform olefin plastics into resins suitable for a variety of commercial and industrial applications. The company’s advanced approach ensures post-consumer recycled plastics are recycled and converted into resins for their highest and best use – keeping them out of landfills, incinerators, and the world’s oceans. Circulus is contributing to the circular economy by recycling plastics and eliminating waste.

View website

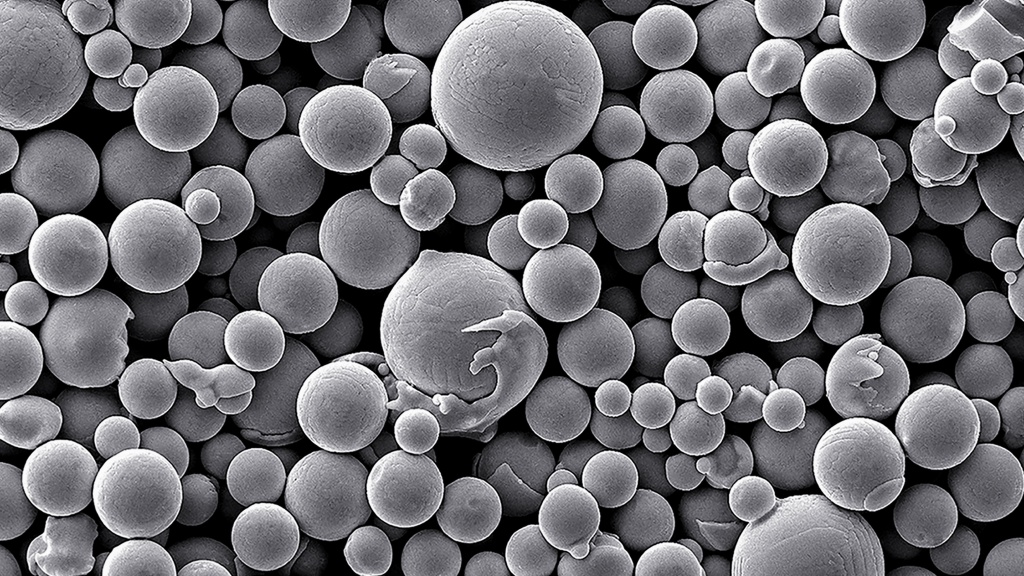

Continuum

Founded in 2015 as Molyworks, Continuum is a sustainable metal recycling company, with locations across the United States and in Singapore. Creator of The Greyhound, a patented compact foundry revolutionizing metal manufacturing. The Greyhound eliminates reliance on external supply chains, and enables customized, controlled and internal circularity, unique to each manufacturer’s needs. Continuum deploys Greyhound technology globally to produce a wide variety of metal powders locally.

View website

CycleØ

CycleØ actively develops and operates biomethane projects across Europe. The Company’s proven proprietary technologies are designed to capture, process and upgrade naturally occurring methane gas produced principally by the agri-food and livestock industries. In addition to farmers becoming distributed energy producers of the future, they will dramatically reduce their greenhouse gas emissions while maintaining current outputs.

View website

Divert

Divert is an impact technology company on a mission to protect the value of food. Divert is transforming the food value chain by creating innovative and efficient solutions to eliminate food waste. The company creates advanced technology and sustainable infrastructure to prevent wasted food, recover edible food to serve communities in need, and divert food waste from landfills.

View website

Fluitron

Based just outside of Philadelphia, PA, Fluitron is a market leader in the manufacturing of customized gas compression equipment. Fluitron manufactures diaphragm compressors, pressure vessels, and piston compressors for industrial gas and hydrogen applications, and provides aftermarket services including maintenance, repairs, and spare parts. Founded in 1976, Fluitron currently operates worldwide and has in-house manufacturing, engineering, and design capabilities.

View website

Genera

Genera is a vertically integrated U.S.-based non-wood agricultural pulp and sustainable packaging company. The company is headquartered in Vonore, Tennessee where it operates an integrated non-wood pulp plant and molded fiber manufacturing facility capable of producing 36,000 tons of agricultural pulp annually.

View website

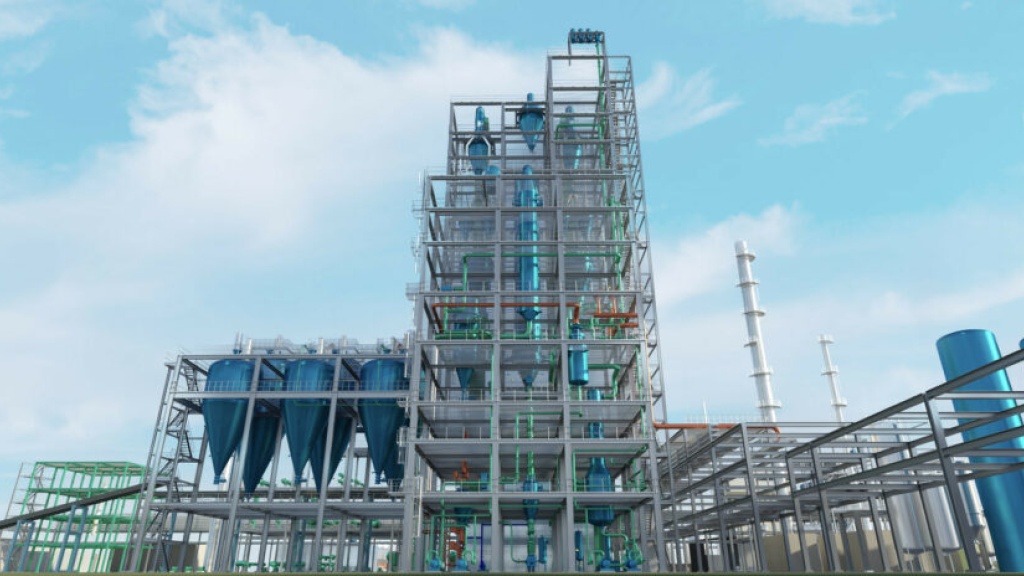

GIDARA Energy

Founded in 2019, GIDARA Energy focuses on unlocking the value of waste feedstocks turning them into valuable sustainable fuels and circular chemicals while at the same time reducing CO2 emissions. The key for this is its proprietary High-Temperature Winkler (HTW®) gasification technology. With over a decade of commercial-scale waste gasification experience, the patented HTW® technology is the leading operational waste gasification process. GIDARA Energy is active in licensing HTW® technology and offering gasification solutions to partners. GIDARA Energy’s build, own, operate project, Advanced Methanol Amsterdam (AMA), integrates HTW® gasification to produce advanced methanol from waste wood and MSW (municipal solid waste).

View website

Lincoln Terminal

Lincoln is a leading provider of terminal services with an entrenched position in the Southeast and Mid-Atlantic regions. The company provides throughput and storage solutions for renewable fuels. Lincoln’s transloading facilities are located across five states and are uniquely focused on reducing carbon emissions through automation, and driver and transportation efficiency.

View website

Natural World Products

Natural World Products is Ireland’s leading recycler of organic waste, managing 330,000 tonnes of household organics annually across the Island of Ireland. It processes 50% of all recycling from Local Authority Collected Municipal Waste in Northern Ireland, supporting councils in meeting statutory targets and advancing their Net Zero commitments. Over the past decade, it has diverted more than 2 million tonnes of organic waste from landfill.

View website

Paratus

Paratus offers the world’s first renewable power, transition fuels and freight price-risk insurance policies to protect producers and consumers from excessive balance-sheet exposure. Paratus’ transparently priced policies eliminate the need for costly in-house trading capabilities, and the use of complex hedging products. Guernsey domiciled and regulated by the Guernsey Financial Services Commission to underwrite general business. Paratus Maritime Insurance Limited transfers risk to particular Underwriters at Lloyd’s (rated “A+” by Standard & Poor’s and “AA-” by Fitch Ratings), to enhance financial security for clients worldwide.

View website

Path

Path is a technology-enabled, decarbonizing industrial services platform. The company cleans storage tanks and rail tank cars using proprietary methods which reduce emissions, landfill waste and man-hours. Path’s differentiated service offering serves the agriculture, chemical, food & beverage, petrochemical, pulp & paper and refining industries throughout North America.

View website

Petainer

Petainer offers a wide range of sustainable PET packaging solutions which allow its customers to reduce their carbon footprint. It has over 35 years of experience designing and manufacturing high-quality, cost-efficient products with circularity as a core principle. It operates eight sites in Europe, the Americas and Asia to serve customers globally.

View website

Polar Performance Materials

Polar Performance Materials has developed a breakthrough process for manufacturing the world’s highest-purity and lowest-cost High Purity Alumina (HPA). HPA is a critical specialty material for green technologies such as LEDs, lithium-ion batteries, semiconductors, aerospace, and industrial applications. Polar has a much lower-emission process compared to incumbent alumina production processes. The company manufactures its ultra-high-purity HPA products in Oakville, Ontario.

View website

Priority Power

Priority Power is an independent energy management services provider of renewable power and demand response solutions. It manages 9.8 TWh of energy annually and enables significant reduction of carbon emissions by replacing diesel generators with cleaner power from the electrical grid.

View website

Puraglobe

Puraglobe is a carbon-negative producer of high-specification synthetic lubricants. It transforms used oils into advanced, sustainable base oils, motor oils and lubricants—that help mitigate CO2 emissions—and provide outstanding fuel-efficiency and eco-efficiency.

View website

px Group

px Group is a leading provider of comprehensive and integrated services encompassing operations and maintenance, engineering and energy management across the entire UK energy and industrial complex. The company has over 25 years’ experience operating and managing highly complex energy and industrial infrastructure assets, earning a strong reputation for bringing an “owner’s mindset” to the facilities that it operates.

View website

Repeats

Based in the Netherlands, Repeats — Recycled PE AT Scale — is a pan-European plastics recycling platform transforming polyethylene (PE) plastic waste into resin suitable for a variety of commercial and industrial flexible plastic applications.

View website

Soane Technologies

Soane Technologies is a zero-waste alternatives and carbon conversion platform. The company provides a specialty materials product suite supported by 100% biodegradable nano-cellulose, and is separately deploying technology that converts CO2 into valuable industrial gases and carbon solids.

View website

Transform Materials

Transform Materials is a process technology provider for the low-carbon production of acetylene and high-purity hydrogen. Its process is significantly cleaner than the legacy methods of manufacturing acetylene due to cleaner feedstock, lower energy usage, zero waste and lower total carbon footprint.

View website

USD Clean Fuels

USDCF is a developer of terminal assets for renewable fuel feedstocks and biofuels. USDCF’s team has decades of experience utilizing rail transportation as its competitive platform to provide timely, efficient, flexible and cost-effective midstream infrastructure for customers to access the most competitive markets. USDCF’s assets include the West Colton Rail Terminal and additional projects in North America.

View website

Utility Global

Utility Global offers fuel cell technology centered around a state-of-the-art oxide-ion chip, which leverages the latest developments in manufacturing, sensing, control, and nanotechnology.

View website

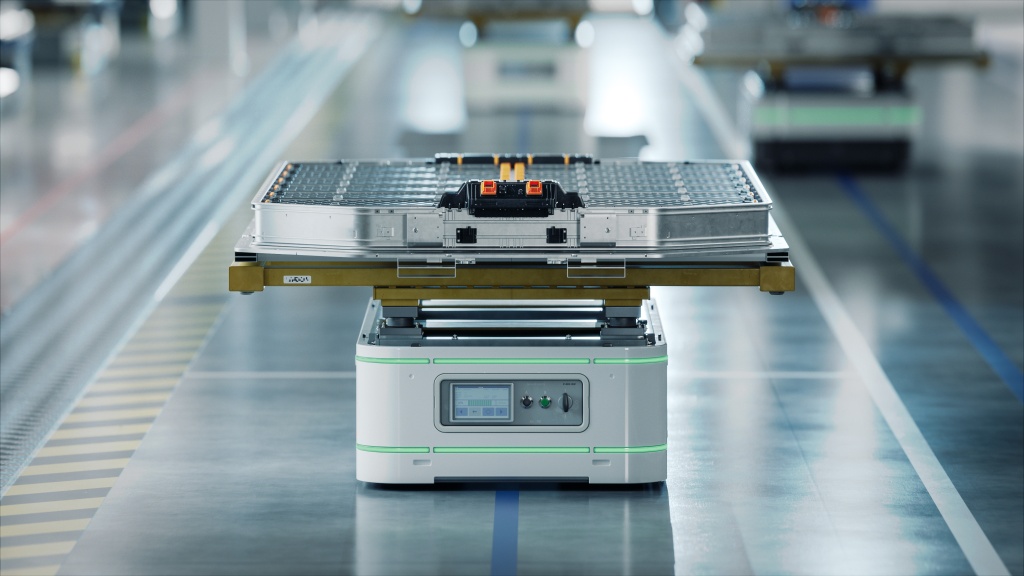

VAC

VAC is a leading global producer of advanced magnetic solutions, rare earth permanent magnets, and inductive components that are crucial for the decarbonization of our planet. With more than 100 years of application know how and experience in material science and product development, VAC designs and manufactures mission critical solutions for a wide variety of industries, including renewable energy, e-mobility, automotive, industrial automation, medical, aerospace and defense. VAC’s unique ability to develop and manufacture from base elements through final products enables us to provide customers optimal form factors and performance, generating best in class efficient solutions in an environmentally conscious manner.

View website

Wattstor

Wattstor is a market-leading provider of turnkey behind the meter (BtM) automated energy solutions for small to medium scale industrial and commercial business, pairing energy management software with battery energy storage systems (BESS) and solar PV modules.

View website