Sonali Aggarwal

Principal

This quarter has been marked by significant achievements that underscore our commitment to decarbonize the industrial economy.

We successfully closed Ara Infrastructure Fund I, along with co-investment vehicles, securing over $800 million in commitments—a clear reflection of strong investor confidence in our mission to drive industrial decarbonization. Our 2024 Industrial Decarbonization Report, released in May, highlights our tangible progress, showcasing substantial emissions reductions and waste diversion across the portfolio.

Our portfolio companies continue to lead and innovate in their respective sectors: GIDARA Energy formed a strategic alliance with global industry leaders to advance sustainable aviation fuel production; Continuum Powders achieved breakthrough results in metal recycling with Siemens Energy; Divert broke ground on a new facility addressing food waste in the Southeastern United States; and Paratus established a first-of-its-kind strategic partnership with Low Carbon, a leading independent renewable power producer.

Additionally, we are pleased to welcome Onur Goker as Managing Director and Sonali Aggarwal as Principal to our Private Equity team. Their expertise across multiple sectors will enhance the firm’s capabilities and further strengthen our commitment to industrial decarbonization.

Thank you for your ongoing partnership. Together, we are paving the way toward a resilient, lower-carbon future.

Charles Cherington & Troy Thacker

Managing Partners

Ara Infrastructure Fund I officially closes above target

Co-led by Teresa O’Flynn and George Yong, Ara Infrastructure reached a final close of over $800 million for its debut fund, Ara Infrastructure Fund I, including associated co-investment vehicles. The Fund exceeded its $500 million target, drawing strong support from Ara’s existing investor base and a diverse set of new institutional investors.

The 2024 Industrial Decarbonization Report highlights the strong decarbonization results of our private equity and infrastructure portfolio, achieving a reduction of 1.7 million metric tonnes of CO2e and 542,000 metric tonnes of waste. The report features the successful exit of Priority Power, demonstrating how embedding decarbonization into core business strategy creates substantial enterprise value that scales under new ownership. The investment themes section explores critical focus areas for industrial decarbonization across Ara’s target sectors.

1 Absolute/realized emission reduction amounts calculated irrespective of Ara’s % equity share. 2024 data is based on best available information from the company and third-part y analysis, and relies on certain assumptions. For illustrative purposes only. Reductions include amounts directly resulting from Ara portfolio company operations, in addition to reductions realized by third parties as a result of services provided by portfolio companies. Excludes cross fund investments.2 Passenger vehicle and garbage truck equivalency based on 2024 EPA GHG Equivalencies Calculator.

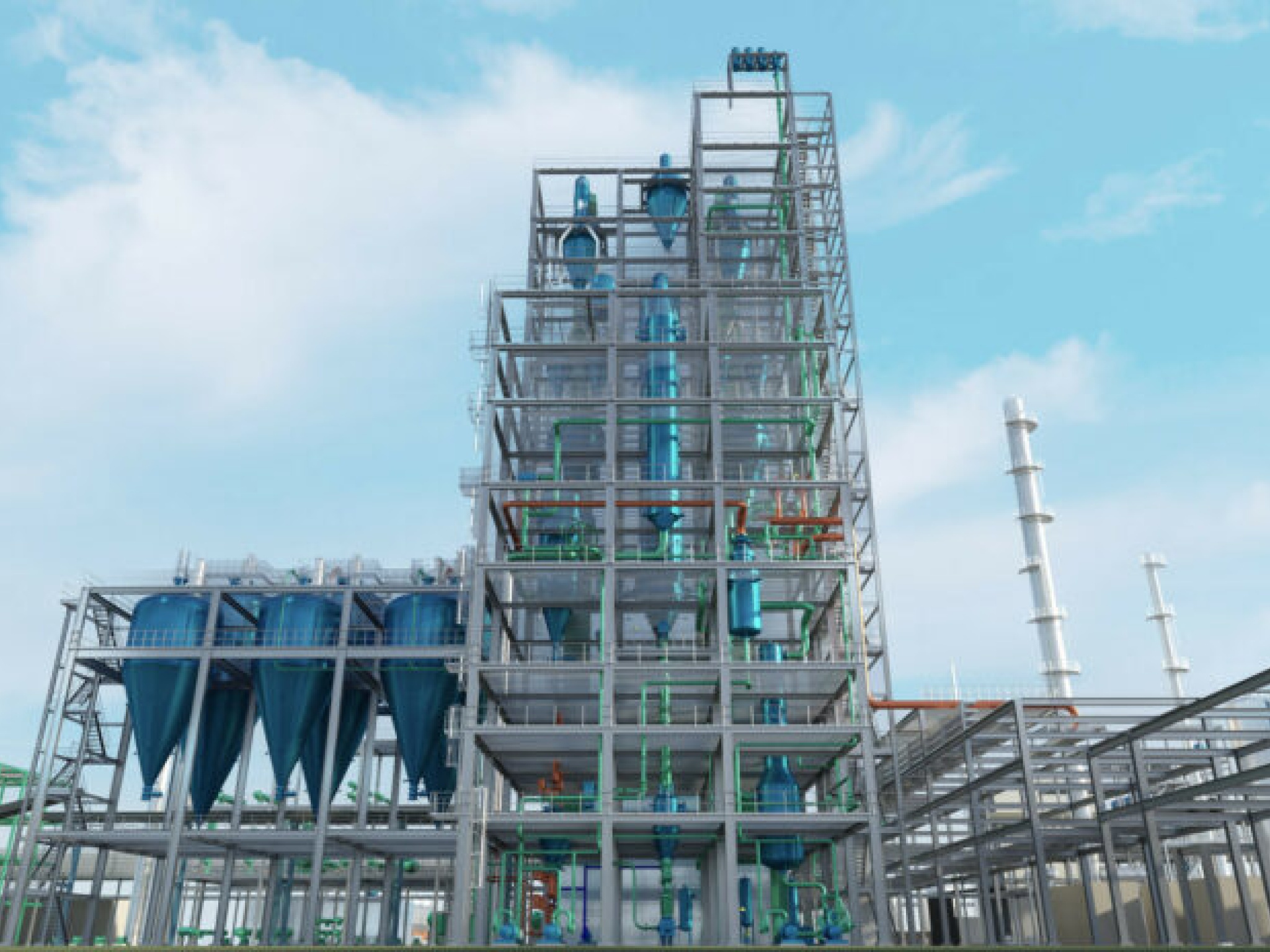

Honeywell, Johnson Matthey, GIDARA Energy, and SAMSUNG E&A have formed a strategic alliance to drive the end-to-end production of SAF from biomass and municipal waste.

Paratus Holdings, the world’s first (re)insurance group dedicated to energy price risk, has formed a strategic partnership with Low Carbon, a leading independent renewable power producer.

Continuum Powders, a leader in sustainable metal powder production driving circular manufacturing for critical industries, achieved industry-leading results by recycling nearly one ton of nickel scrap per week from a Siemens Energy facility.

Utility, a clean hydrogen technology leader, was named one of the World’s Top GreenTech Companies of 2025 by TIME and Statista—earning the #59 spot globally and #32 in the U.S.

Divert, Inc. breaks ground on Lexington, NC facility, demonstrating growing momentum nationwide and addressing the critical need for infrastructure to reduce food waste in the Southeast U.S.

Blue Whale Materials was featured in the June 2025 Edition of Recycling Today, highlighting the company’s journey to establish a commercial-scale lithium-ion battery recycling facility in Bartlesville, OK.

This quarter, Ara hosted two Safety Summits, one in Dublin and one in Houston, bringing together 70 leaders from across the portfolio to share best practices, explore the future of workforce safety, and strengthen organizational approaches to safety.

Alex Cass, Head of Investor Relations at Ara Partners, spoke with Anne-Louise Stranne Peterson at Infrastructure Investor about the future of natural gas given growing electricity demand driven by AI applications.

Ara Partners welcomes Onur Goker as Managing Director and Sonali Aggarwal as Principal to its Private Equity team

Onur brings deep experience in clean energy, energy efficiency, electric transportation, industrial efficiency, and sustainable food production, while Sonali adds a decade of deal flow and value creation expertise across multiple sectors, including industrials. Their talents will further strengthen Ara’s commitment to decarbonizing the industrial economy.

Principal

Human Resources Business Partner

Executive Assistant and Office Manager

Managing Director

Director, APEX